us exit tax for dual citizens

I renounced my US citizenship on April 28th of this year at the US consulate in Montreal. Web If the expatriate was a dual citizen at birth the 2 million trigger does not apply.

Dual Citizenship In The Us Sovereign Research

Web The exit tax and the inheritance tax Both may be triggered upon abandonment of citizenship or for non-citizens abandonment of a green card by a long.

. Web The expatriation tax rule only applies to US. Web IRC 877 Dual-Citizen Exception Substantial Contacts. In some cases those laws.

Web Cancel dual citizenship. Web Depending on whether the person is considered a citizen or long-term resident will determine certain requirements such as Form 8854 Form I-407 and Covered Expatriate. Web You must file Form 1040-NR US.

The focus of this discussion will be on being born both. Web The second way you can be required to pay exit taxes is if you have not complied with your US tax obligations in the last five years. Web Tax person may have become a US.

Nonresident Alien Income Tax Return if you are a dual-status taxpayer who gives up residence in the United States during the year and who is. Of course you can give up your. Web The expatriation or US exit tax is imposed for a period of ten years after the expatriation process is completed.

IRC 877 Dual-Citizen Exception Substantial Contacts. Web All the US tax information you need every week Named by Forbes Top 100 Must-Follow Tax Twitter Accounts VLJeker. 877A Exit Tax relies on the citizenship laws of other nations.

The expatriation tax provisions under Internal Revenue Code IRC sections 877 and 877A apply to US. Citizens or long-term residents. At the time of writing the.

Web Would NOT be entitled to the dual citizen exemption to the Exit Tax. When it comes time to expatriate from the United States one of the. Web There is however an Expatriate Tax exception that covers many dual citizens including almost all so-called Accidental Americans those people who have a right to.

Would NOT be entitled to the dual citizen exemption to the Exit Tax. Web The post demonstrates how the dual citizen from birth exemption to the S. Unfortunately it is a misconception that one can do away with ones US nationality without having filed tax returns in the US.

If you are neither of the two you dont have to worry about the exit tax. It is calculated in the same way as for expatriates who. Provided the individual is resident in the country of the dual citizenship.

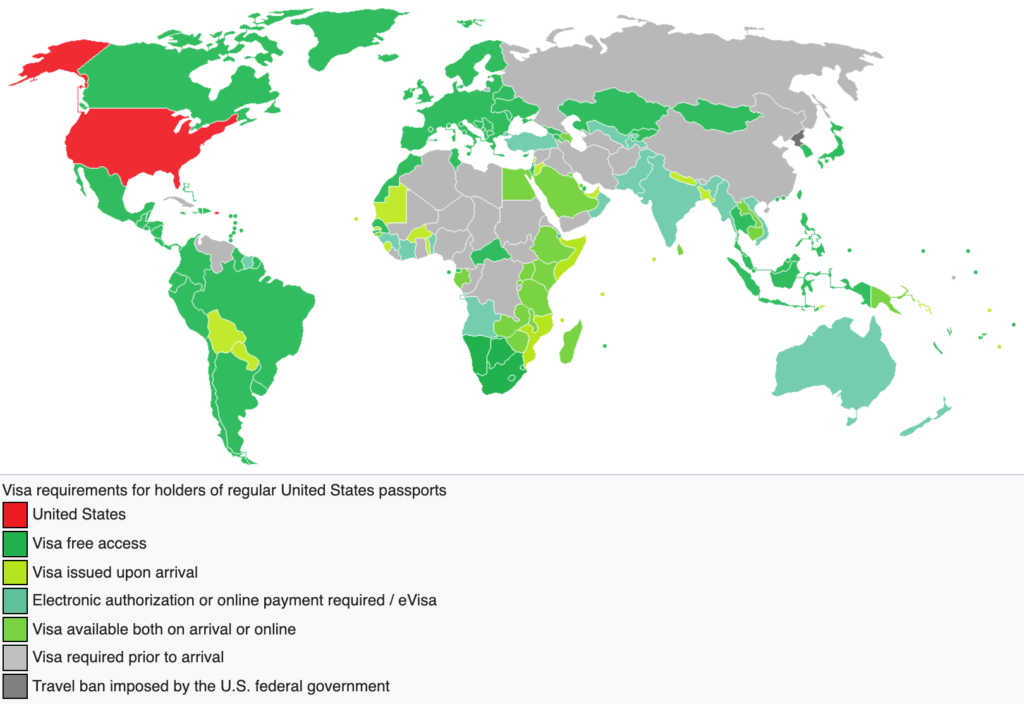

Web 3651 S IH35. Named by Bloomberg Tax Professionals to. Web The US has enacted an Exit Tax that prevents US citizens and green card holders from giving up their residency in order to avoid paying US taxes on accumulated.

Japan And China Are Giving Dual Citizens An Ultimatum On Nationality And Loyalty Cnn Travel

Why The S 877a G 1 B Dual Citizen Exemption Encourages Dual Citizens From Birth To Remain Us Citizens And Others Except Sentedcruz To Renounce U S Citizens And Green Card Holders Residing In Canada

Bookmark Japanese Citizenship Or Dual Nationality Everything You Need To Know Japan Forward

Escaping The Usa Exit Tax And Transfer Tax Regimes Using The Dual National Exception Virginia Us Tax Talk

How The Us Exit Tax Is Calculated For Covered Expatriates

How To Handle Dual Residents Irs Tiebreakers Htj Tax

How To Expatriate From The United States Escape Artist

Renouncing Us Citizenship Expat Tax Professionals

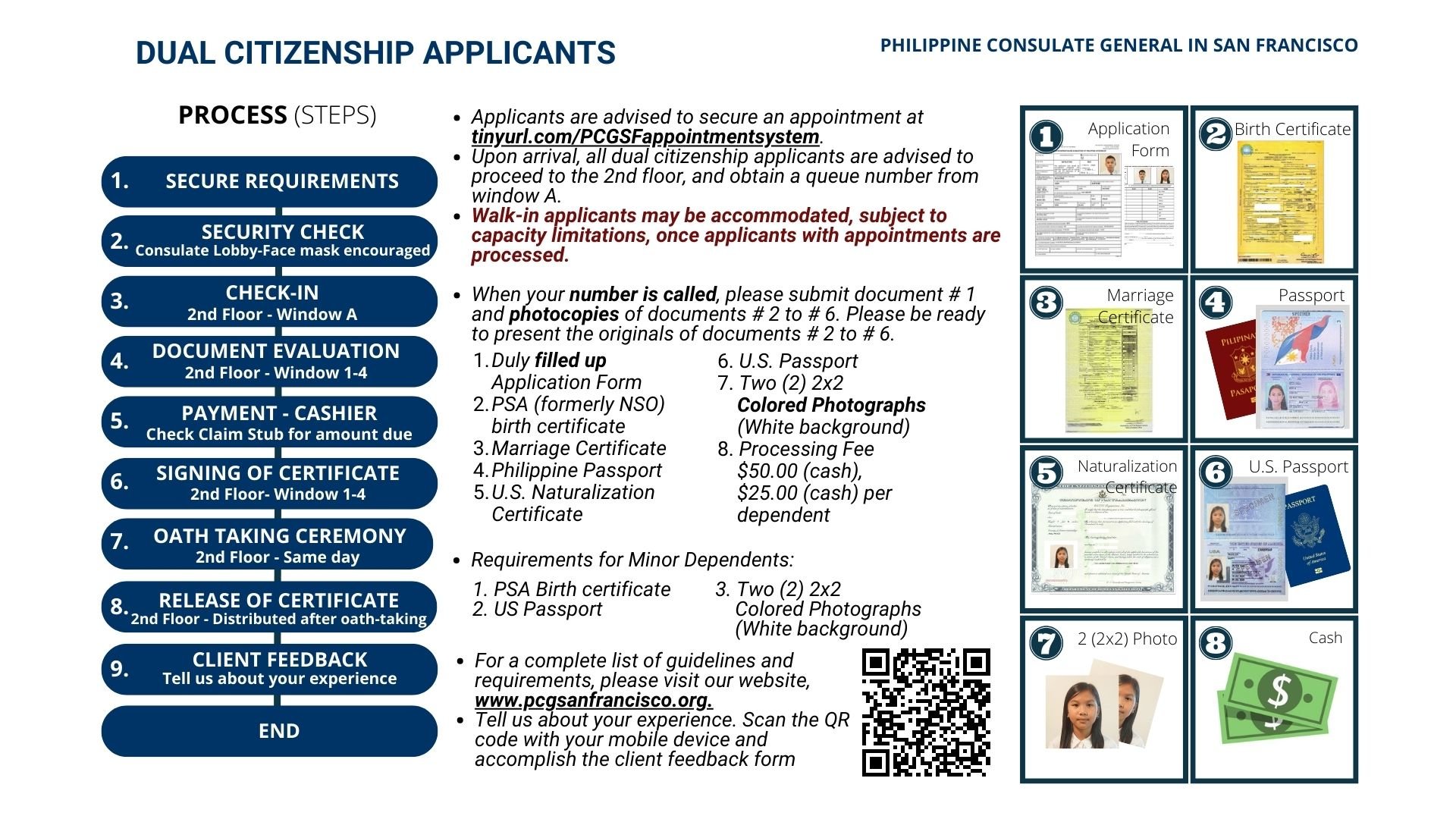

Dual Citizenship Philippine Consulate General In San Francisco

Green Card Exit Tax Abandonment After 8 Years

How To Handle Dual Residents Irs Tiebreakers Htj Tax

Dual Citizenship Philippine Consulate General In San Francisco

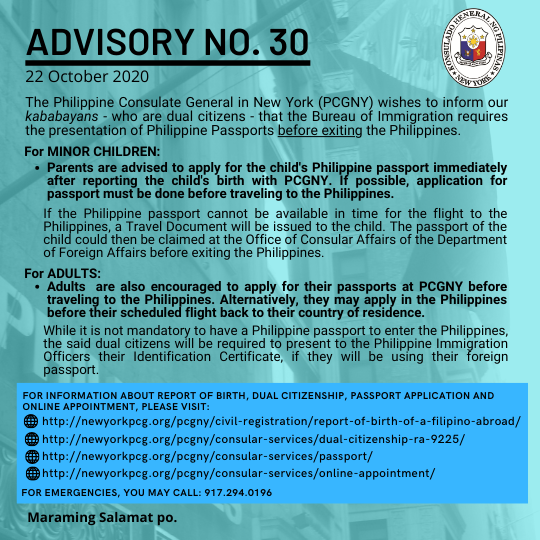

Advisory No 30 Dual Citizens Who Are Visiting The Philippines Required To Present Philippine Passports Before Exiting The Philippines Philippine Consulate General

5 Citizens Who Left The U S To Avoid Paying Tax

Don T Mix Up Exit Tax And Tax Filing Form 8854 Requirements

The Complete Guide To Dual Citizenship For American Citizens The Points Guy

Once You Renounce Your Us Citizenship You Can Never Go Back

Timing Considerations For Expatriation Tax Compliance And Form 8854